Newsletter | October 2025

8 October 2025Newsletter,Financial News

Gold has climbed above $4,000 a troy ounce for the first time, Gold hit $4,036 early on Wednesday

11.9% PERFORMANCE OF GOLD IN SEPTEMBER

Investment perspective

The global economy is showing resilient, albeit slowing, growth, with projections of around 3.2%-3.3% for 2025 and just below 3.0% for 2026. This growth is being held back by tariff uncertainties and geopolitical risks. The US economy is expected to undergo a brief slowdown, supported by anticipated interest rate cuts and policy stimulus. Labour market risks remain the most critical factor in the near term. The eurozone experienced stagnation in Q3 due to the unwinding of export front-loading and tariff effects. However, underlying growth momentum and government spending are expected to support a rebound in Q4. Private consumption remains a key driver of growth. The European Central Bank (ECB) has stated that recent interest rate cuts should begin to stimulate growth, particularly through robust household spending fuelled by rising real disposable income and a gradual decline in the savings ratio. Despite some temporary setbacks and demanding valuations, corporate earnings growth is expected to remain healthy globally, supporting equities. In this context, the primary US index closed last week at a record high. As the earnings season is about to begin, consensus estimates put year-on-year earnings per share growth at 6.0% in Q3. This seems quite conservative, including for the 'Magnificent Seven', and should therefore easily be surpassed, possibly even exceeding expectations. The outlook remains positive globally. US equities are at record highs, while European equities are supported by fiscal spending and much more attractive valuations. Despite global uncertainties, emerging markets saw stronger growth and relative stability in September. These markets continue to benefit from valuation advantages and improving financial stability. However, risks remain in the form of tariffs, inflationary pressures and geopolitical tensions. Commodity prices, particularly gold, have fluctuated significantly, and the US dollar has weakened moderately due to investor caution and expectations of monetary easing. The depreciation of the US dollar has further amplified the rally in gold prices and provided a tailwind for emerging market currencies. Other commodities showed a mixed performance. While oil prices faced mild downward pressure due to ample supply, industrial metals remained relatively stable amid ongoing demand for infrastructure projects in emerging markets.

Investment strategy

The US equity market recently hit record highs. The IT heavyweight index continues to benefit from strong performance in companies such as AMD (which has a strategic partnership with OpenAI) and Nvidia. Despite tight valuations, momentum has been supported by optimism surrounding the potential for Federal Reserve interest rate cuts later in the year, as well as robust corporate activity. However, the ongoing US government shutdown is a significant source of uncertainty. It has delayed the release of key economic data, including the jobs report. While this has increased the risk of market volatility, it has not yet dampened positive investor sentiment. As with the recent resignation of the French prime minister, the shutdown could create uncertainty around monetary policy decisions, but it may also present opportunities to buy at a low price. Moderate excesses in sentiment and seasonal trends suggest that investors will embrace opportunities ahead of Q3 earnings releases, despite low expectations, as there is potential for positive surprises. The AAII Investor Sentiment Survey shows that although bullish sentiment is above the long-term average, it is nowhere near the extreme euphoria seen at previous market peaks. This reflects a moderate level of optimism among investors. Volatility indices suggest calm markets, indicating that investor fear remains subdued, though there is some greed present. Lower volatility and growing momentum typically signal positive market sentiment and can encourage further equity advances.

France’s Prime Minister Sebastien Lecornu resigned, creating political instability

Portfolio Activity/ News

In early September, in anticipation of challenging seasonality in the equity markets this month and given high valuation levels, we reduced our exposure to the credit markets after achieving strong performance. The cash generated from selling some of our high-yield credit exposure was invested in alternatives, specifically gold and an alternative trend strategy. At the same time, we reduced our overweight position in equities slightly by reducing our weighting in the US market. This reduction was reinvested in short-term liquidity instruments to maintain the flexibility to return to the markets in the event of a sharp decline or confirmation of the September trend. In retrospect, we should have maintained our US equity position. However, gold performed exceptionally well, rising by 11.9% in US dollar terms. Furthermore, to hedge against a potential further decline in the US dollar, we favoured instruments hedged in various portfolio reference currencies. It should also be noted that our alternative investment selection, particularly the alternative trend strategy, had a record month, with an increase of 5.8% in US dollar terms versus 3.6% for the broad US market index. We would like to highlight the continued strong performance of our global and emerging market managers, a segment in which we have a significant presence. The latter recorded a return of 6.7% in US dollars in September and has achieved a return of over 27.5% so far this year. Our stance remains constructive on the equity and credit markets, leading to a mildly risk-on posture. If market dynamics are confirmed, as they were in early October when key support levels were broken, particularly in Europe, we could consider returning to the equity markets selectively to take advantage of the current momentum.

Download the Newsletter

Newsletter | September 2025

3 September 2025Newsletter,Financial News

Federal Reserve Chair Jerome Powell opened the door ever so slightly to lowering key interest rate in the coming months

12.8% PERFORMANCE OF THE CHINA A ONSHORE INDEX IN AUGUST

Investment perspective

Forecasts for real GDP growth in the second half of the year suggest slower quarter-on-quarter growth rates in most regions. Although some major economies, such as the US, Canada, the Eurozone and China, have recently reported stronger-than-expected 2Q GDP growth, leading to upward revisions in fore-casts, this momentum is expected to weaken, at least temporarily. As we have often emphasised in previous editions, this slowdown reflects the increase in effective US tariff rates, the unwinding of the initial growth boost from tariff front-running effects, and high levels of uncertainty and restrictive monetary conditions, particularly in the United States. Incidentally, regarding monetary policy, there is a growing probability of mod-est rate cuts in the US. This has caused the dollar to decline by 2.2%, reversing the gains made in July, and has pushed the US Dollar Index (DXY) towards multi-year lows. This was triggered by Federal Reserve Chair Powell’s Jackson Hole speech, in which he highlighted labour market weakness that could soon out-weigh inflation concerns. This has led to market expectations of potential rate cuts starting in September. The weak dollar has caused yields in US Treasury markets to drop as investors anticipate monetary easing. However, concerns about reduced foreign demand for US debt amid fiscal deficits have subsequently raised borrowing costs. Meanwhile, the European Central Bank is expected to keep interest rates at their current level, whereas the Bank of England cut rates by 25bps, from 4.25% to 4.00%, marking its fifth rate cut since August 2023. This was due to rising unemployment, albeit with inflation stubbornly remaining high at 3.6%. Nvidia’s results reinforced confidence in the AI-driven tech sector rally, showing robust growth in AI infrastructure spending. Despite the strong earnings beat, the stock price initially declined in after-hours trading because data centre rev-enue missed a narrow forecast, and the absence of any China sales prompted a cautious investor response. Meanwhile, crude oil prices fell by around 4.1% due to rising supply, increased production and geopolitical tensions dampening bullish momentum, all of which are concerns about demand. Precious metals gained as Federal Reserve Chair Powell’s dovish speech lowered funding costs.

Investment strategy

Trump’s aggressive tariffs, unpredictable immigration poli-cies, and the trajectory of budget deficits have introduced significant economic uncertainty. Tariffs risk pushing inflation higher, restraining Federal Reserve easing and raising long-term bond yields. The hawkish stance of the US central bank has infuriated Pres-ident Trump, who has demanded an aggressive cut in interest rates from the current level of 4.25–4.50% to as low as 1.3%. Trump has intensified his attacks on the Fed's independence by attempting to remove Fed Governor Lisa Cook for alleged financial fraud. This would give Trump a majority on the Fed’s board and potential control over key monetary policy levers. We remain cautious about the trend in long-term interest rates and continue to favour intermediate maturities. In Eu-rope, the highly probable fall of the French government has once again put pressure on peripheral sovereign issuers. Within fixed income, our strongest conviction remains in credit, particularly in emerging market corporate credit, due to its solid fundamentals and attractive yield. As these securi-ties are generally issued in US dollars, we recommend favouring those with currency hedging to avoid the current negative trend in the US dollar. The end of summer is traditionally associated with concerns about September and its unfavourable seasonality. This is more than just a myth; historically, this month has been the worst for the main US stock market index. Since 1945, the in-dex has fallen by an average of 0.75% during September, making it the worst month of the year on average.

French government risks collapse with budget confidence vote in September

Portfolio Activity/ News

Overall, we kept to our original allocation throughout the month, a decision that proved wise given the favourable ongoing trends in the credit and equity markets. However, the negative effects of the weak US dollar, which rebounded in July, were evident once again. The narrowing of credit spreads continued to support this segment of the bond market. Given its current level, we should no longer expect this component to have a positive impact on future returns. We have been monitoring this trend for several months, and at current levels we are considering reducing our positions. After creating a small position in small- and mid-cap US stocks for our US dollar-based portfolios, which we gradually increased, we began the same process for our euro-based investors. In addition to attractive valuations and better earnings growth, Europe’s ongoing structural investments – particularly Germany’s fiscal spending plans and increased defence spending – are positive growth drivers for this sector. Mid-cap stocks also tend to be more domestically focused and less dependent on global supply chains, which can be advantageous amid global trade uncertainties. Despite the risks posed by global trade tensions, US political uncertainty, and inflationary pressures, we maintain a positive stance on emerging market equities. These markets offer balanced opportunities through improved regional cooperation, attractive valuations, and supportive macroeconomic momentum. The Federal Reserve is widely anticipated to implement two to three rate cuts by year-end. However, political challenges affecting Fed independence and ongoing tariff-related legal disputes are adding to market uncertainty, undermining confidence in the US dollar as a safe haven. Consequently, we are minimizing US dollar exposure to mitigate risk amid an accelerating downward trend.

Download the Newsletter

Newsletter | August 2025

11 August 2025Newsletter,Financial News

The US Federal Reserve held interest rates steady; speculation persisted regarding potential rate cuts in the fall.

5.8% PERFORMANCE OF THE MAGNIFICENT SEVEN INDEX IN JULY

Investment perspective

Last month was characterised by fragile global economic resilience, buoyant but volatile financial markets, and ongoing political efforts to resolve regional conflicts. Growth risks remain skewed to the downside, particularly if trade uncertainties worsen or fiscal trajectories prove unsustainable. Indeed, persistent uncertainty over trade policy and high tariff levels continue to weigh on the long-term outlook, with the expected decline in the share of global trade in output. The US economy is showing signs of slowing down, with growth now projected to be between 1.3% and 1.9%, depending on the source. Meanwhile, inflation is staying elevated at around 3.0% per annum. A pronounced “risk-on” sentiment emerged during the month as several new trade agreements were announced. This boosted global equities and pushed up bond yields, particularly in the US. Short-term US Treasury yields rose sharply, by around 24 basis points, reflecting the expectation of a delay in Federal Reserve interest rate cuts. Although the European Central Bank and the US Federal Reserve both held policy rates steady, markets continued to price in cuts (with the Fed expected to act in September), adding to yield curve volatility. Meanwhile, major US equity indices reached new all-time highs, driven by robust earnings from the technology and AI sectors, as well as renewed investor confidence following adjustments to trade policy. The US dollar experienced significant volatility in July. After starting the month weakly amid softer inflation and dovish Fed remarks. The dollar rebounded midway through the month as stronger economic data and cautious language from the Fed reduced expectations for imminent rate cuts. By 30 July, the dollar index had rebounded to around 103.6 from an earlier four-month low, but it remained down by around 8–11% year to date on a trade-weighted basis. Major currency pairs remained within their established ranges, while the yen experienced periods of strength as the Bank of Japan suggested potential changes to its policies. July was a dramatic month for copper. Prices on New York’s COMEX soared in early July, rising by over 13% at one point, after President Trump unexpectedly floated the idea of a 50% tariff on copper imports, which far surpassed market expectations. In a stunning reversal, however, refined copper was abruptly exempted from the tariff until at least January 2027, causing the premium to evaporate and leaving US warehouses with stocks at a 21-year high.

Investment strategy

Despite the announcement of new trade agreements, particularly with Japan, which will see a 15% tariff imposed on all products imported into the United States, followed by the European Union with an identical rate, fears of a global economic slowdown remain central. The erratic announcements regarding the final level of customs duties have caused more uncertainty, which is a key factor for markets and investment, than can be seen in the published data to date. However, the latest job creation figures, particularly the revised estimates for recent months, serve as a stark reminder that difficulties may lie ahead for the US economy. The latest inflation figures have also been reassuring, but the concrete effect of the tariffs remains to be seen. Against the backdrop of a potential economic slowdown and stable inflation of around 3%, the Fed has chosen to maintain the status quo. J Powell's inflexible stance has further damaged his already poor relationship with Donald Trump. The US President is demanding a rate cut to ease the burden of growing US debt — a position also held by David Warsh, who is tipped as a potential replacement for Powell as head of the US central bank. Despite these uncertainties, the markets are optimistic, with signs of euphoria in some cases. This does not yet call into question our risk-on positioning. However, we remain alert to a potential reversal in market dynamics and sentiment, which could indicate the need for greater caution.

Replacing Powell Would Not Guarantee Lower Short-Term Rates

Portfolio Activity/ News

Throughout July, we largely maintained our risk-on stance. As a reminder, this was characterised by a preference for credit over government bonds in the fixed-income segment and a resolutely growth-oriented approach to equities. This approach served us well while the credit market remained buoyant. However, we continued to diversify the bond portion by introducing positions in bonds issued by financial companies, such as banks and insurance companies. This allowed us to capture the excess yield resulting from the subordination of the securities. We reiterate our cautious stance on long-term government bonds (10+ years). In this segment of the bond market, we are maintaining a position with an average maturity of between five and ten years. The average interest sensitivity of our bond portfolio is approximately 4.5 years. We maintain a favourable bias towards technology-related sectors, especially those that benefit from artificial intelligence, in all regions. In terms of the geographical distribution of our equity holdings, we have increased our exposure to US equities slightly, while maintaining significant exposure to European and emerging market equities. Despite the uncertainty caused by trade tensions, the latter have achieved impressive growth since the beginning of the year. Within our alternative investment portfolio, while recent performance has been mixed following a strong first half of the year, we maintain a high level of conviction in our strategic exposure to key alternative investment trends and strategies.

Download the Newsletter

Outlook | 2H 2025

26 June 2025Investment perspectives,Financial News

Executive summary

The first half of 2025 was marked by significant market volatility, driven by heightened policy uncertainty and geopolitical tensions. The fear index reached its third-highest level on record! During this period, European and emerging market (EM) equity markets significantly outperformed US equities, especially when priced in local currencies. Meanwhile, long-term bond yields increased due to concerns about fiscal deficits, particularly in the US.

Elevated uncertainty and trade barriers are expected to hinder growth significantly, while inflation is forecast to moderate slowly on a global scale. Central banks are likely to remain cautious, suggesting that rate cuts are unlikely to resume before September.

Key risks include an escalation of conflict in the Middle East, despite the current calm following the US Air Force's bombing of Iranian nuclear infrastructure. Other risks include renewed inflationary pressures due to disrupted oil supplies, for example via the closure of the Strait of Hormuz, and tariff escalations, which could trigger recessions in major economies.

Economic Outlook

Global growth will remain below pre-pandemic averages of around 2.3% to 2.9%

Growth moderation is broad-based, with notable slowdowns in the US and China

Elevated and persistent trade barriers and tariffs are a significant drag on global growth

Inflation is expected to continue moderating globally, albeit at a slower pace

Central banks are expected to maintain a cautious stance

The U.S. Federal Reserve may hold rates steady through much of 2025

Spending to support the economy will lead to rising fiscal deficits and debt levels

Key Risks

Divergent and rapidly changing monetary and fiscal policies may tighten financial conditions and destabilise markets.

Conflicts and sanctions could disrupt trade, energy supplies and investment flows.

Rising public debt and fiscal imbalances may limit policy flexibility and increase sovereign risk premiums.

Renewed inflationary pressures could derail plans for monetary easing, prolong tightening cycles and increase borrowing costs.

Further tariff increases or re-escalation could trigger recessions in major economies and worsen global growth.

Investment Convictions

Modest overweight in credit, especially in the high-yield and investment-grade sectors.

Focus on intermediate sovereign bonds as the yield curve is expected to remain upward-sloping due to fiscal deficits and risk premia ('sweet spot').

Gold remains a hedge against inflation surprises and, more importantly, geopolitical risks.

Mid-caps still present opportunities for valuation expansion and earnings growth, making them an attractive addition to large-cap allocations.

Large-cap US stocks, particularly in the technology and growth sectors, are benefiting from AI and innovation and should therefore be favoured within the equity allocation.

Currency tailwinds and relative valuation discounts against the US dollar support emerging market equities. A modest overweight position is warranted.

In Europe, fiscal stimulus in defence and infrastructure may offset some of the headwinds caused by trade disruptions.

Table of contents

- OUTLOOK 2H 2025 : EXECUTIVE SUMMARY

- 1H 2025 REVIEW : KEY HIGHLIGHTS

- OUTLOOK 2H 2025

- INVESTMENT CONVICTIONS

- ALLOCATION VIEWS

Download the Outlook 2H 2025

Newsletter | June 2025

2 June 2025Newsletter,Financial News

The US Congress has passed a tax bill that will boost the budget deficit.

7.2% PERFORMANCE OF THE EUROPEAN MID-CAP INDEX IN MAY

Investment perspective

Geopolitical and economic factors persisted in May, most notably the ongoing impact of punitive tariffs introduced by the U.S. administration in early April, which continued to reverberate across global markets. Although temporary tariff reprieves have calmed the situation, the fundamental direction of US trade policy remains restrictive, with the potential for further escalation or prolonged uncertainty, which could affect global growth and inflation. This dual pressure complicates monetary policy, especially for the Federal Reserve, and affects market expectations. As we pointed out earlier this year, divergent monetary policies have become the norm. The uncertainty induced by the tariffs led the Federal Reserve to adopt a wait-and-see approach, while the European Central Bank (ECB) remained on its path of gradual easing. Overall, this could result in higher terminal U.S. interest rates due to reduced capital inflows and an increased risk premium. This dynamic could further steepen the yield curve as investors demand higher compensation for heightened uncertainty. After credit spreads widened sharply, the 90-day tariff reprieve for certain countries eased some fears partly, leading to a retracement in credit spreads. U.S. investment grade (IG) corporate spreads tightened from 116 basis points (bps) in early April to roughly 88 bps by the end of May, while U.S. high yield (HY) corporate spreads narrowed from 450 bps to 315 bps. Following a sharp sell-off in early April, during which the primary U.S. index fell by over 10.5% in two days, May saw a strong recovery in the equity markets. The Magnificent Seven experienced a notable rebound during the month, as did heavy tech-weighted and growth-oriented indices. Nvidia and Tesla led the way with impressive returns of around +24.1% and +22.8%, respectively, in May. Despite the headwinds encountered in the early part of the year, the Magnificent Seven have demonstrated resilient earnings growth. Goldman Sachs projects earnings per share growth for the group of around 28% in 2025, which is significantly higher than the expected 9% growth of the broader market index. The bank also noted that the group is currently trading at its lowest valuation levels in two years, which could present an attractive entry point. The U.S. dollar has registered weakness against the euro for the fourth consecutive month. However, the pressure eased somewhat with a loss of 0.4%, bringing the year-to-date loss to over 9%.

Investment strategy

Although market sentiment has improved with the recovery in consumer confidence and a slight easing of tariff fears, the complexity of fiscal and trade dynamics remains. The outlook for the U.S. fiscal deficit has deteriorated significantly, with the Congressional Budget Office and Fitch Ratings projecting deficits in excess of 7.5% of GDP in 2025 and 2026. A comprehensive tax and spending bill that is currently making its way through the Senate is expected to increase the debt by trillions, with little prospect of significant spending cuts. This fiscal deterioration is putting upward pressure on long-term Treasury yields, as evidenced by the recent 30-year bond yield reaching its highest level since October 2023. Market sentiment continues to be affected by instability in trade policy, with the risk that tariff-related disruptions will impact key economic indicators such as GDP and corporate earnings. Nevertheless, recent signs of recovery in US consumer confidence could bolster domestic demand. In light of the fiscal outlook and the increasing supply of long-dated Treasuries, we are exercising particular caution regarding the long end of the curve and are favouring the front end to mitigate the risk of further yield increases. Market sentiment indicators have shown a swift and significant recovery from the extreme pessimism observed in April. This recovery in sentiment has coincided with a rebound in growth and technology stocks, including the 'Magnificent Seven', suggesting that momentum remains a key driver.

Fed is facing the possibility of both higher inflation and weaker economic performance

Portfolio Activity/ News

Over the month, our portfolios benefited significantly from the market recovery, particularly in terms of our equity and credit allocations. We maintained our exposure to European and US credit, encompassing investment grade (IG), high yield (HY) and emerging corporate bonds, while continuing to exercise caution regarding long-maturity bonds, particularly in the US. Despite the very different dynamics at play in Europe, the risk of the curve steepening further has led us to reduce our exposure to long-term government bonds and retain only intermediate-term bonds. Although we marginally increased our equity allocation, adding US growth and emerging market exposure, we maintained a structural preference for European equities, driven by attractive valuations and supportive monetary policy dynamics. European assets are well placed to benefit from the unfolding US fiscal agenda and shifting allocations away from US assets, which are still under-represented in most portfolios, as well as from gradual dollar depreciation. Having tactically increased our equity exposure earlier in the month, we are now adopting a slightly more cautious approach, as market sentiment indicators have swung rapidly from deeply depressed levels to mild complacency. We are increasingly inclined to reduce our US dollar exposure further, anticipating that the deteriorating fiscal deficit and persistent economic uncertainty will weigh on the currency. However, we believe it is still too early to reduce risk across the entire portfolio, as the recovery is ongoing and we are positioned only slightly overweight.

Download the Newsletter

Newsletter | May 2025

2 May 2025Newsletter,Financial News

The IMF has cut its growth forecast for global economic growth this year to 2.8%, compared with 3.3% in January

25.3% PERFORMANCE OF GOLD SINCE THE BEGINNING OF THE YEAR

Investment perspective

April will be remembered as the month of tit-for-tat tariffs, with the dramatic announcement of reciprocal tariffs. Indeed, on 2 April, the US President announced the details of these reciprocal tariffs. Although widely expected, they came as a surprise because of their magnitude (10% base tariff from 5 April + additional tariff equal to half the ratio of the US bilateral trade deficit divided by US imports from 9 April). The announcement of 34% reciprocal tariffs on Chinese imports prompted China to impose 34% tariffs on US goods on 4 April. On 9 April, Trump hit China with an additional 85% levy on all imports, bringing the total to 104%. On the same day, China announced retaliatory tariffs of 84% on imports of US goods, further escalating the trade war between the world's two largest economies. On the same day, Trump raised tariffs on Chinese imports to at least 145% before announcing a 90-day pause on "reciprocal" tariffs, except for China. On 11 April, China raised its retaliatory tariffs on US imports to 125%. These punitive tariffs are undoubtedly a bargaining chip in negotiations with US trading partners, and the tariffs ultimately imposed after negotiations may be less severe. However, the risk of escalation will ultimately weigh on economic growth and reignite fears of a resurgence in inflation. This recessionary scenario (more than 60% probability at Goldman Sachs) of tariffs has triggered a sharp downturn in financial markets, with the US dollar being a large casualty. Perhaps in response to the market turmoil caused by the growing risk of recession and a sharp tightening of financial conditions, the US President has announced a 90-day pause on reciprocal tariffs. The delay in implementation and the possibility of a more favourable negotiated agreement than the announced tariffs allowed markets to breathe a sigh of relief. This return to relative calm after an unprecedented shock allowed the main stock market indices to record a minimal decline of 0.5% for US equities in US dollar terms, with the Magnificent Seven even rising 0.7% over the month, and European equities in euro terms falling 0.8%. The cut in global growth forecasts led to a sharp fall in the oil price, which fell 18.6% over the month. In contrast to credit and equity markets, the US dollar did not follow this rally and fell 4.5% against the euro in April, following an already 4.1% decline in March.

Investment strategy

After a month of extreme uncertainty, as evidenced by the rise in volatility indices across all asset classes, the month ended on a note of optimism thanks to the de-escalation announcements from the White House. The disruption caused by Trump's tariff hikes has reduced the potential for American exceptionalism to continue. The attempt to reshape global trade by imposing tariffs on all US imports has increased the risk of a global economic slowdown and the perceived risk of a US recession. Economists have cut their global growth forecasts, with the median down to 2.7% from 3.0% in January. This turmoil, caused by Trump's policies but also by uncertainty about future relations with an unpredictable administration, sent markets into a sharp correction. In total, the Magnificent Seven lost $2.3 trillion in value since 21 January, the day after Donald Trump's inauguration, with $1 trillion lost on inauguration day alone. Are we witnessing a bear-market rally (usually fast and sharp), or the start of a new secular cycle following a temporary shock, in this case tariffs, fuelled by a prolonged artificial intelligence cycle? This is not a trivial question, as a pause in trade tensions has contributed to the recent rally in risk assets. A shift away from the original tariffs could indeed prolong the rally, although the economic impact will be felt in upcoming economic data. Since 1950, the US equity market has experienced 19 peakto-trough drawdowns of more than 15%. The current correction is mild compared to previous recessionary periods.

“Analysts Are Calling for Earnings Growth Rates of 6.4%, 8.8%, and 8.3% for Q2 2005 to Q4 2025"

Portfolio Activity/ News

After intense activity in the first quarter, which led us to substantially reduce equity and dollar exposure in our portfolios, we decided to leave our positioning unchanged in April. We remain neutral on equities, with a bias towards European assets at the expense of the US. This positioning has helped our portfolios to mitigate the impact of the sharp fall in the US currency, while capturing the strong outperformance of European assets since the beginning of the year. It should be noted that we may consider reducing this directional bias if a more constructive return on large US technology companies is confirmed. We have started this rotation towards more technology-focused content with a more global positioning, which proved profitable during the rally in the second half of April. We are also encouraged by the results and the constructive commentary accompanying the earnings releases, confirming continued investment and demand in the artificial intelligence sector. We have maintained our bond convictions, namely a preference for European duration, a clear path to the front end of the curve and a broad credit exposure across all sectors and geographies. In this uncertain environment, we believe it is essential to seek resilience through a large, uncorrelated and high-performing alternative allocation. While volatility has reached high levels, so too has the dispersion of performance across alternative segments. Our position selection and sizing have been prudent and have been rewarded in terms of performance. We are maintaining our positions and plan to increase the weighting of this type of strategy through new additions. We recognise the strategic stabilising role of gold but acknowledge that a return to a risk-on market environment and a correction cannot be ruled out, which would offer more attractive entry levels.

Download the Newsletter

Newsletter | April 2025

2 April 2025Newsletter,Financial News

The Swiss National Bank cuts its key interest rate by 25 basis points to 0.25 per cent in March

11.4% PERFORMANCE OF COPPER

Investment perspective

We have an almost unanimous consensus that recent soft data, such as surveys, are pointing to a likely deterioration in US growth, while the reported growth and inflation releases have been in line with expectations at the start of the year. What will happen if the figures confirm the negative impact of the new US administration's economic policies on both growth and inflation ? Even if many economists have already revised their forecasts for US growth, indicators following economic surprises do not seem to show any major deterioration. However, we are back in a world where many forecasters are predicting a US recession within two years with a probability of more than 30%. While political uncertainty reigns in the United States, from tariffs to possible major cuts in government spending, the rest of the world, and Europe in particular, is showing renewed optimism. This more constructive attitude towards economies outside the United States stems from an easier reading of economic policies that could have lasting structural effects on growth. The lack of investments has for years undermined the attractiveness and competitiveness of the eurozone. The announcement of substantial spending plans to address, among other things, the vulnerability of supply sources and defence needs is undeniably encouraging investors, as the rally in European markets and the euro seems to confirm. We believe that we are on the verge of significant flows into European assets, due to the under-representation of the zone in portfolios, but above all sustainable because of the structural measures taken by the European authorities in relation to assets outside the United States. Certainly, the movements since the beginning of the year have opened investors' eyes to the degree of concentration of their portfolio due to the dominance of an ever-smaller number of significant contributors to performance and the imperative need to increase their exposure outside the US. As at the end of the 1990s, so-called ‘value’ assets such as Europe may remain in the penalty box for longer than anticipated but can prove to be very profitable in the event of a lasting turnaround, as US equities have been since the great financial crisis of 2008-2009.

Investment strategy

The next few days will be crucial, with important announcements on tariffs that will provide more clarity on the real impact on growth and inflation. These clarifications can help provide a clearer picture of the new policy framework, which markets, consumers and producers desperately need in order to operate with confidence. As a discounting mechanism, financial markets have already priced in these uncertainties and are now awaiting the announcements with some trepidation to understand the real impact of these new tariffs. In this context, economic growth has been revised downwards and is now expected to be around 1.5%, compared with over 2% at the end of 2024. Despite their one-off effect, the tariffs and their countermeasures will push up consumer prices by almost 3.5% year-on-year. Similarly, downward revisions to US economic growth and S&P 500 earnings growth estimates have been swift. Indeed, higher tariffs will not only hurt growth, but also lead to a new surge in inflation, which could negatively impact the earnings potential of many companies. Earnings growth forecasts for the S&P 500 have been revised sharply downwards from over 10%, with the consensus now expecting low single-digit earnings growth in 2025. The US equity market is the most exposed to the deteriorating economic environment, with the spectre of recession looming. Historically, US equities have fallen around 25% from their peak during recessions.

“35% Probability That the US Economy Enters a Recession During the Next 12 Months” (GS)

Portfolio Activity/ News

The US administration's flip-flops on economic policy, in particular tariffs, influenced our portfolio activity, which was higher than usual. We started 2025 with an equity bias. However, in the first half of January, we considered it appropriate to reduce our risk for the first time and then to reduce the equity allocation in several steps to an underweight position by mid-March, compared to a near maximum overweight position at the end of December 2024. At the same time, we rotated more towards European equities and away from US equities due to their high valuation, strong performance and growing uncertainties about American exceptionalism. This proved productive as European equities (+5.9% in euro terms) outperformed US equities (-4.6% in US dollar terms). In addition, the euro gained 4.5% against the US dollar following the announcement of a fiscal turnaround in Germany. In euro terms, the difference between the two markets in the first quarter was 15%. After a sharp correction of more than 10% in 22 days (the 6th fastest correction in the last 75 years), while conscious of the risks associated with the tariff announcements of 2 April, we returned our equity allocation to neutral and strengthened our bond allocation by increasing our exposure to emerging market corporates. We continue to favour credit (investment grade and high yield) and European bonds (interest rate sensitivity around 6 years) due to their solid fundamentals, better future growth prospects and attractive carry. In these uncertain times, an allocation to so-called alternative strategies can have a crucial stabilising and risk-reducing effect. We currently favour macro and alternative trend-following strategies.

Download the Newsletter

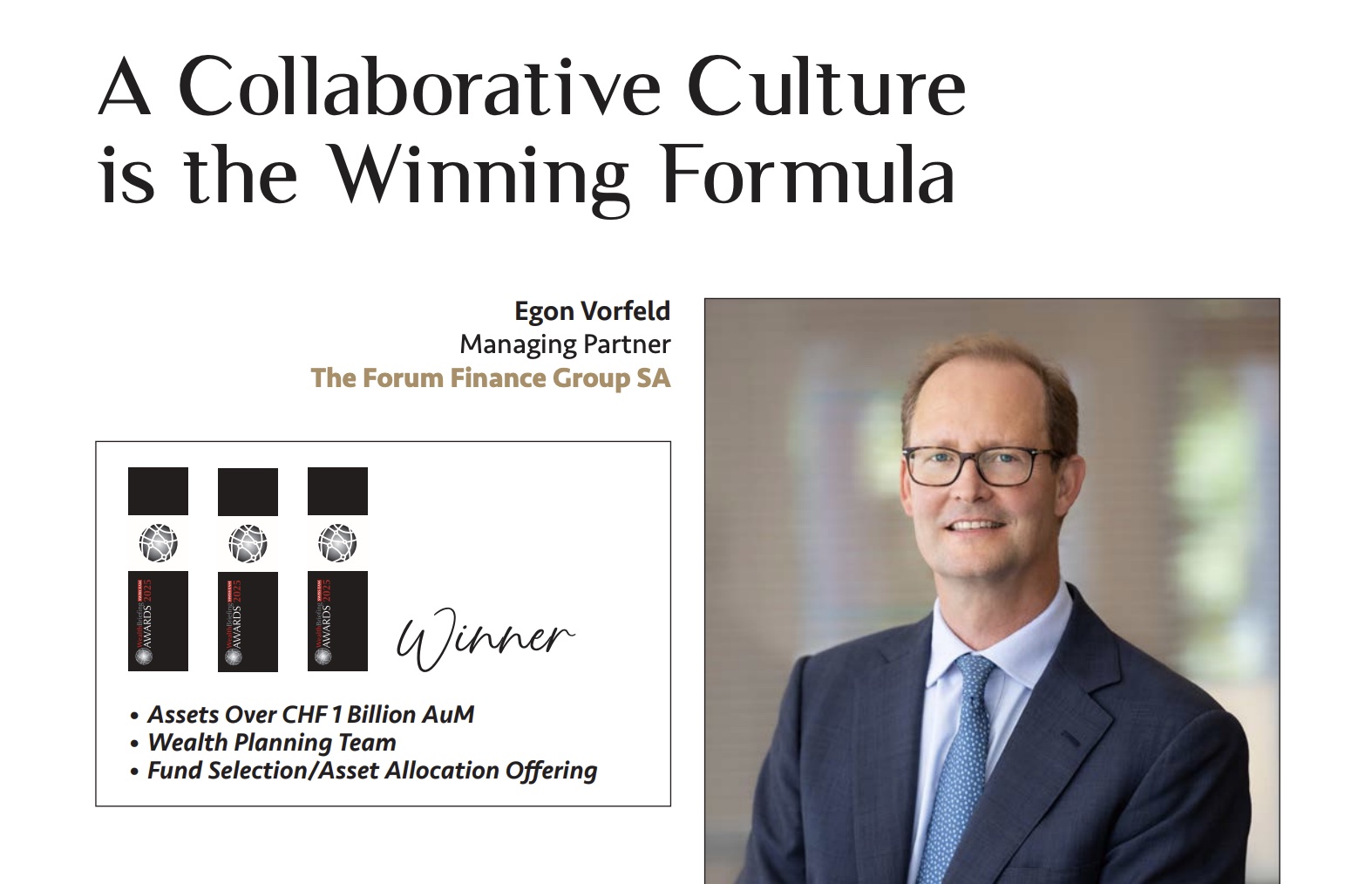

A Collaborative Culture is the Winning Formula

25 March 2025Press Releases & Sponsoring

We are delighted to be the recipient of three WealthBriefing accolades for 2025. Forum Finance has evolved over the last 30 years to become one of the leading EAMs in the Swiss market. With assets under management close to CHF2bn and 26 employees we rank among the top 3% of actors in the Swiss market.

What was the winning formula of your firm that explains why you won the awards?

We are very grateful to the independent panel of judges for their diligent work and could not be more delighted with our three awards. These awards are a real testament to our consistent investment and planning for the company over many years. Our winning formula may be the combination of our focus on how we can best serve our clients and how we can best inspire our employees. We have done so by engendering a highly collaborative and equitable culture at Forum Finance – something so very different from a cost-sharing or platform model. This however requires a generous spirit among our partners and employees, where everyone is incentivised and keen for the company as a whole to do well. The effects of this collaborative culture are very much felt by our clients and provides much better outcomes for everyone.

Newsletter | March 2025

7 March 2025Newsletter,Financial News

The ECB cuts interest rates to 2.5% as inflation in Europe is under control

-8.7% PERFORMANCE OF THE MAGNIFICENT SEVEN

Investment perspective

The outstanding feature of the beginning of this year has undoubtedly been the remarkable performance of European equities compared with US equities. The former are up 10.3% in euro terms, while the latter are effectively flat. Investors had emphasised American exceptionalism as a source of explanation for the incredible returns of US equities, leading to a degree of concentration that many considered to be a potentially unsustainable trend. The rotation in market leadership coincided with a shift in focus from expensive global technology names, which are by nature more global and potentially negatively affected by a full-blown trade war, to cheaper and beaten-down sectors, regions and stocks such as Europe. At a macro level, the new US tariff policy of, for example, 25% on Canadian and Mexican imports and 10% on Chinese imports has kept political and economic commentators on their toes. Not only does it mark a clear break with current doctrine, but it is also a major source of uncertainty that could, like Covid, cause significant damage to supply chains. The announcement of the suspension of US military aid to Ukraine, following the debacle of the White House meeting and the failure to sign an agreement on mining resources, has provoked a wave of indignation from the major European countries, both in style and in substance. The breakdown in transatlantic trust could serve as a signal to Europe. Moreover, it seems that Europe is ready to take up the challenge of a US retreat in the Ukrainian conflict and to reaffirm its unwavering support for the Ukrainian cause. The outcome of the German elections is a source of optimism. Indeed, we could soon see announcements of a major investment plan and an easing of budgetary constraints. These investments are crucial for Europe's competitiveness and should provide a tailwind for European growth. In the bond markets, the favourable trend in credit continued, with a slight easing in US 10-year rates. In commodities, oil prices fell by around 3.8% in WTI terms, while gold rose by 2.1% in US dollar terms. The latter remained stable against the major European currencies over the month.

Investment strategy

Merz's conservatives won Germany's election by a comfortable margin over rival parties. The other big winner was the far-right AfD, with a record 20.8% of the vote. The coalition agreement with the Social Democrats was followed by the announcement of an unprecedented fiscal plan that exempts defence spending from the debt brake and includes a €500bn fund for infrastructure spending over the next 10 years. While the proposal still needs to be passed by parliament later this month, the historic U-turn on public spending has been felt in financial markets, sending the euro and government borrowing costs higher. This radical departure from the obsession with debt sustainability, coupled with a clearer ECB policy thanks to moderating inflation and the prospect, albeit still distant, of a ceasefire in Ukraine, continues to support European equities. The publication of weak US economic figures and a deterioration in consumer confidence, linked to the growing uncertainties associated with the decisions of the new Republican administration, have revived fears in the markets, whether legitimate or not, about economic growth. These fears about the future health of the US economy have led to a reduction in risk appetite and a flight to quality that has allowed 10-year US government bonds to fall from 4.8% in mid-January to below 4.30% despite persistent inflation.

US Commerce Secretary Lutnick Hints at Possible Tariff Relief After Market Sell-Off

Portfolio Activity/ News

After convergence, we are entering an era of divergence and disruption in both form and substance. While nothing can be taken for granted, increased uncertainty will continue to weigh on markets and be a source of significant volatility, both up and down. Given the increased political uncertainty across the Atlantic, but also the persistence of high geopolitical tensions, we have continued to reduce our equity exposure. We continue to favour European equities. However, we are aware that the rise in European indices has been rapid and that a pause or a slight correction would be welcome to calmly consider the continuation of the upward trend. We are staying away from Japanese equities and maintaining a neutral stance on emerging markets. Reducing our exposure to US equities has also allowed us to reduce our exposure to the US dollar. As a reminder, we had more than 35% exposure to the US currency in the fourth quarter of 2024 and have gradually lowered it to around 20%. To take advantage of potential bouts of volatility, we are holding the proceeds of our equity sales in cash to mitigate the impact of any declines, but also to take advantage of any exaggerations. These reductions have brought our equity exposure to an underweight position. At the same time, we have increased our allocation to liquid alternative strategies to add resilience to our portfolios. We remain constructive on European yields, although we are not particularly pleased with the recent movement in German yields. We maintain our preference for European credit, where carry remains attractive, and fundamentals are strong.

Download the Newsletter

Forum Finance wins three awards at the WealthBriefing Swiss EAM Awards 2025

6 March 2025Press Releases & Sponsoring

Forum Finance wins three awards at the WealthBriefing Swiss EAM Awards 2025

Geneva, 6th March 2025 – Geneva-based independent asset manager The Forum Finance Group SA has won three major awards at the fifth WealthBriefing Swiss EAM Awards 2025. In particular, it was declared winner by the jury in the Asset over CHF 1 Billion AuM, Fund Selection/Asset Allocation Offering and Wealth Planning Team categories.

Announced during the prize-giving ceremony held last night in Zurich, the awards showcase ‘best of breed’ in Switzerland, the awards have been designed to recognise outstanding organisations grouped by specialism and geography which the prestigious panel of independent judges deemed to have “demonstrated innovation and excellence during the last year”. Each of these categories is highly contested and is subject to a rigorous process before the ultimate winner is selected by the judges. It is this process that makes WealthBriefing awards so prized amongst winners. Participants around the world recognise that winning these awards is particularly important in these challenging times as it gives clients reassurance in the solidity and sustainability of the winner’s business and operating model.

With regard to the best Swiss EAM with Assets Over CHF 1 Billion AuM, the judges’ choice “stands out for its forward-thinking approach to regulation and succession planning. With strategic senior hires, a diversified client base, and a focus on emerging opportunities like AI, blockchain, and energy transition, FFG exemplifies successful adaptation and growth in a dynamic market”.

In relation to the Fund Selection/Asset Allocation Offering, the jury selected Forum Finance for “excelling in fund selection and asset allocation. With over 30 years of expertise, the group’s analysts carefully evaluate a broad spectrum of investment instruments to craft tailored portfolios, ensuring optimal returns for each client through a rigorous, proven selection process”.

Concerning the Wealth Planning Team, the judges’ winner “demonstrates exceptional dedication to wealth planning with a specialized in-house team. Their commitment to delivering comprehensive wealth and tax planning solutions, coupled with personalised strategies from expert wealth planners, sets them apart in providing tailored, high-quality services that meet the complex needs of their clients”.

Hippolyte de Weck, Managing Partner and CEO of Forum Finance stated: “We are truly honoured to have our strengths and achievements recognized by these highly regarded industry awards. Over the past 30 years, our company has grown significantly to become today one of the leading players in the Swiss market. We are proud of what the whole team here at Forum Finance has achieved. It is our collaborative spirit that really sets us apart!”

Indeed, having anticipated the evolution of the wealth management industry, Forum Finance has strengthened its structure and organisation over the last few years, as evidenced by the CISA licence granted by FINMA in 2015 and its registration as investment adviser with the US SEC in 2016. Forum Finance invests constantly in its research, investment management and wealth advisory resources, as well as in technology, enabling it to respond effectively to the changing needs of its clients.

For additional information, please contact :

Egon Vorfeld

The Forum Finance Group SA

T: +41 (0)22 552 83 00

E: vorfeld@ffgg.com

ffgg.com

About Forum Finance

Founded in 1994 in Geneva, Forum Finance offers private banking and asset management services to a high-end global clientele. It has 26 employees who manage and supervise around CHF 2 billion. The company is authorised under the CISA licence by FINMA and is registered with the SEC as investment adviser.

WealthBriefing Awards recipients are chosen by an independent panel of judges, with selections based solely on merit. These awards are not predetermined and cannot be purchased.