A Collaborative Culture is the Winning Formula

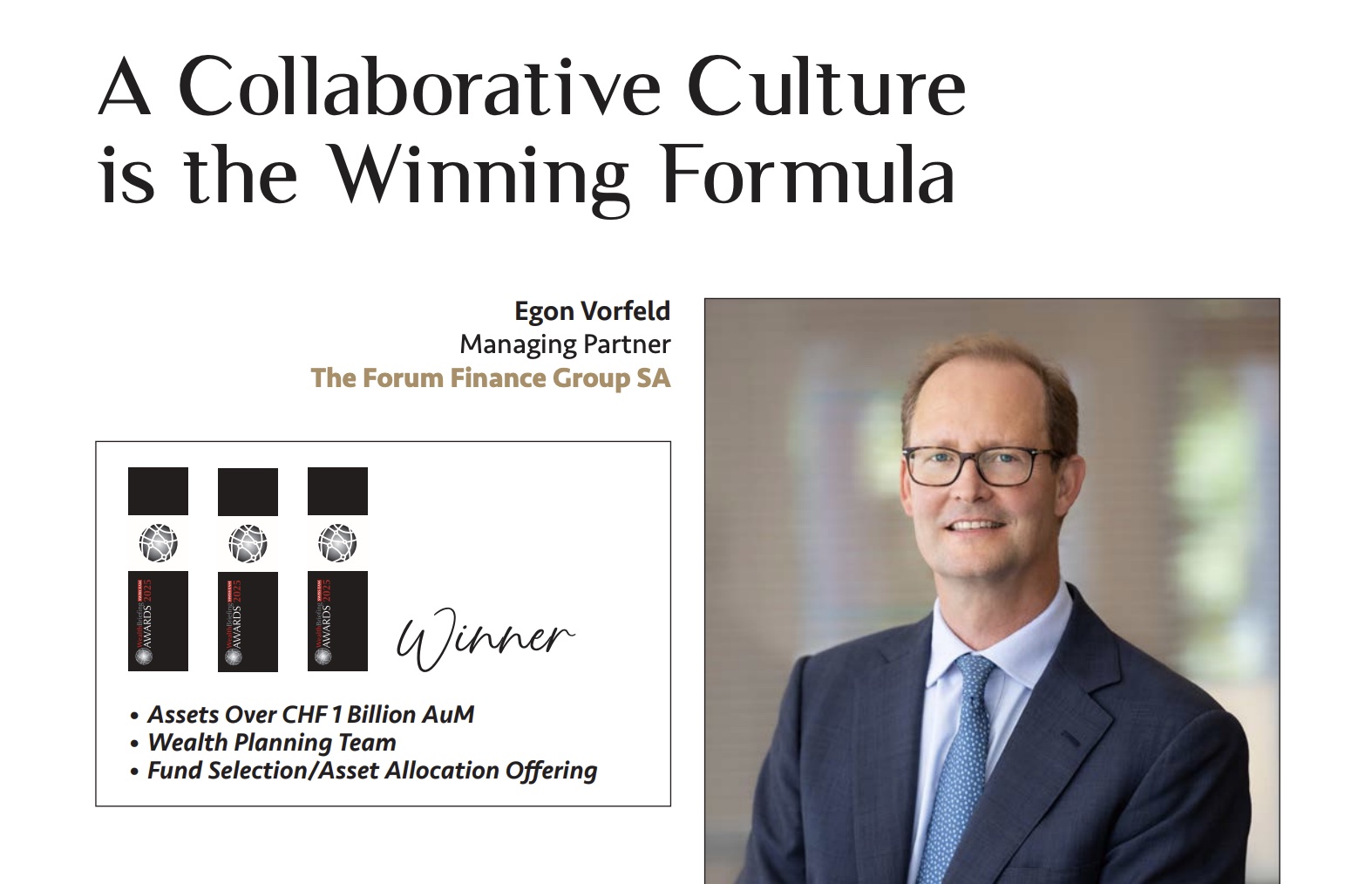

We are delighted to be the recipient of three WealthBriefing accolades for 2025. Forum Finance has evolved over the last 30 years to become one of the leading EAMs in the Swiss market. With assets under management close to CHF2bn and 26 employees we rank among the top 3% of actors in the Swiss market.

What was the winning formula of your firm that explains why you won the awards?

We are very grateful to the independent panel of judges for their diligent work and could not be more delighted with our three awards. These awards are a real testament to our consistent investment and planning for the company over many years. Our winning formula may be the combination of our focus on how we can best serve our clients and how we can best inspire our employees. We have done so by engendering a highly collaborative and equitable culture at Forum Finance – something so very different from a cost-sharing or platform model. This however requires a generous spirit among our partners and employees, where everyone is incentivised and keen for the company as a whole to do well. The effects of this collaborative culture are very much felt by our clients and provides much better outcomes for everyone.

Forum Finance wins three awards at the WealthBriefing Swiss EAM Awards 2025

Forum Finance wins three awards at the WealthBriefing Swiss EAM Awards 2025

Geneva, 6th March 2025 – Geneva-based independent asset manager The Forum Finance Group SA has won three major awards at the fifth WealthBriefing Swiss EAM Awards 2025. In particular, it was declared winner by the jury in the Asset over CHF 1 Billion AuM, Fund Selection/Asset Allocation Offering and Wealth Planning Team categories.

Announced during the prize-giving ceremony held last night in Zurich, the awards showcase ‘best of breed’ in Switzerland, the awards have been designed to recognise outstanding organisations grouped by specialism and geography which the prestigious panel of independent judges deemed to have “demonstrated innovation and excellence during the last year”. Each of these categories is highly contested and is subject to a rigorous process before the ultimate winner is selected by the judges. It is this process that makes WealthBriefing awards so prized amongst winners. Participants around the world recognise that winning these awards is particularly important in these challenging times as it gives clients reassurance in the solidity and sustainability of the winner’s business and operating model.

With regard to the best Swiss EAM with Assets Over CHF 1 Billion AuM, the judges’ choice “stands out for its forward-thinking approach to regulation and succession planning. With strategic senior hires, a diversified client base, and a focus on emerging opportunities like AI, blockchain, and energy transition, FFG exemplifies successful adaptation and growth in a dynamic market”.

In relation to the Fund Selection/Asset Allocation Offering, the jury selected Forum Finance for “excelling in fund selection and asset allocation. With over 30 years of expertise, the group’s analysts carefully evaluate a broad spectrum of investment instruments to craft tailored portfolios, ensuring optimal returns for each client through a rigorous, proven selection process”.

Concerning the Wealth Planning Team, the judges’ winner “demonstrates exceptional dedication to wealth planning with a specialized in-house team. Their commitment to delivering comprehensive wealth and tax planning solutions, coupled with personalised strategies from expert wealth planners, sets them apart in providing tailored, high-quality services that meet the complex needs of their clients”.

Hippolyte de Weck, Managing Partner and CEO of Forum Finance stated: “We are truly honoured to have our strengths and achievements recognized by these highly regarded industry awards. Over the past 30 years, our company has grown significantly to become today one of the leading players in the Swiss market. We are proud of what the whole team here at Forum Finance has achieved. It is our collaborative spirit that really sets us apart!”

Indeed, having anticipated the evolution of the wealth management industry, Forum Finance has strengthened its structure and organisation over the last few years, as evidenced by the CISA licence granted by FINMA in 2015 and its registration as investment adviser with the US SEC in 2016. Forum Finance invests constantly in its research, investment management and wealth advisory resources, as well as in technology, enabling it to respond effectively to the changing needs of its clients.

For additional information, please contact :

Egon Vorfeld

The Forum Finance Group SA

T: +41 (0)22 552 83 00

E: vorfeld@ffgg.com

ffgg.com

About Forum Finance

Founded in 1994 in Geneva, Forum Finance offers private banking and asset management services to a high-end global clientele. It has 26 employees who manage and supervise around CHF 2 billion. The company is authorised under the CISA licence by FINMA and is registered with the SEC as investment adviser.

WealthBriefing Awards recipients are chosen by an independent panel of judges, with selections based solely on merit. These awards are not predetermined and cannot be purchased.

After 30 years of success, Forum Finance has established itself as a leader in independent asset management in Switzerland

After 30 years of success, Forum Finance has established itself as a leader in independent asset management in Switzerland

Geneva, 7 May 2024 – 30 years after its creation, Geneva-based asset management company The Forum Finance Group SA is reaping the rewards of its investments and is thus ready to face the decades to come. With more than 25 employees overseeing almost CHF 2 billion, Forum Finance now ranks among the top 3% of independent asset managers in Switzerland and has the resources to match its ambitions. Thanks to its proven corporate governance, which provides access to capital for new partners, it is able to attract talented individuals who share its entrepreneurial vision

The results of its first 30 years of existence are particularly positive, and Forum Finance celebrated this jubilee in style last month by winning four major awards at the WealthBriefing Swiss EAM Awards 2024 (best ‘Next Gen’ program, best wealth planning team, best service to Latin American clients and best Chief Investment Officer in the person of Cyrille Urfer).

Its size enables Forum Finance to make the investments necessary to ensure its future development, whether in terms of technology or human resources. More fundamentally, at a time when many first-generation investment companies are struggling to find buyers or to ensure the succession of their founders, Forum Finance has for years had an effective and resilient governance system in place, which allows for a smooth renewal of its shareholder base and the arrival of new partners at the helm. This is a convincing argument for private bankers looking for a new home.

Forum Finance was also able to anticipate at an early stage the changes in the asset management industry. As early as 2015, it strengthened its structures in order to obtain a CISA licence from FINMA. Forum Finance is also registered with the SEC, which allows it to deal with US clients and provides an additional guarantee of solidity and transparency. In addition, Forum Finance has been investing for years in its research, investment management and wealth advisory resources, in order to respond effectively to the changing needs of its clients. Forum Finance thus offers wealth managers with an entrepreneurial spirit a solid framework, offering a fair and collaborative culture.

Hippolyte de Weck, CEO of Forum Finance, said: “Our 30th anniversary celebrations are the culmination of two particularly positive years for Forum Finance, with the appointment of two partners in 2022, the arrival of a new partner and the strengthening of our Board of Directors last year, topped off by four awards from WealthBriefing last month. Over the past thirty years, our company has grown considerably to become one of the leading players in the Swiss market. We owe this success, of course, to the commitment of each and every one of our employees, but above all to the trust and loyalty of our customers.”

For additional information, please contact :

Egon Vorfeld

The Forum Finance Group SA

T: +41 (0)22 552 83 00

E: vorfeld@ffgg.com

ffgg.com

Ricardo Payro

Payro Communication Sàrl

T: +41 (0)22 322 13 17

E: :rp@payro.ch

payro.ch

About Forum Finance

Founded in 1994 in Geneva, Forum Finance offers private banking and asset management services to a high-end global clientele. It has 25 employees who manage and supervise around CHF 2 billion. The company is authorised under the CISA licence by FINMA and is registered with the SEC as investment adviser.

Rejuvenation continues at Forum Finance

Rejuvenation continues at Forum Finance

Geneva, 5th April 2023 – Geneva-based independent asset manager The Forum Finance Group SA has appointed two new independent Board members – Biba Homsy and Alain Couttolenc – and a new Partner, Tanja von Ahnen. By strengthening its Board of Directors and regularly giving access to capital to new partners, Forum Finance reinforces its attractiveness for talented individuals and sets the foundations for its ambitious plans for the future.

Biba Homsy is Founder and Partner of Homsy Legal, a law firm based in Switzerland and Luxembourg specialising in financial markets, compliance, and crypto assets. Prior to that, she led teams at the Swiss regulator FINMA for 5 years, and was also Chief Compliance Officer at Credit Suisse, in charge of Luxembourg and its European branches (France, Portugal, Ireland, Austria, Netherlands). She was appointed as one of the 30 global experts in crypto currency by the World Economic Forum (WEF). A lecturer at several universities on compliance, anti-money laundering and Fintech, she holds two master’s degrees in law (French and Swiss universities) and a certification from Harvard Law School on financial regulation.

Alain Couttolenc is Head of Development and External Relations at IPSOS, a global leader in market research. After starting his career in 1995 at Nielsen Mexico, he joined the Renault Nissan Group in 1999 to launch Renault in Mexico as Marketing Manager. After 8 years, he returned to Nielsen as Vice President for Latin America, before moving to Paris then to Geneva, as Managing Director of Nielsen Media and Marketing Effectiveness. Alain Couttolenc holds a master’s degree in marketing from the Kellogg School of Management and a degree in economics from the Universidad Iberoamericana de Mexico. He has been teaching marketing at La Sorbonne since 2011, is a member of the EFFIE Global Awards, a member of the Executive Committee of the Geneva Investor Circle, an invited member of the World Economic Forum’s community of experts, and a member of Trust Valley’s advisory board.

Tanja von Ahnen joined Forum Finance in 2022 after a 16-year long career in private banking at Banque Syz and RBC, primarily servicing wealthy families based in Latin America. Prior to becoming a private banker, she worked as an independent consultant and as a controller with Allianz Insurance. She holds a master’s degree in Economics from Zurich University and Bachelor degree in Economics from Göttingen University.

A solid structure and governance

With nearly 30 years of steady growth, Forum Finance has proven its durability. Its robust and transparent governance guarantees the integrity of its leadership and allows it to welcome new partners to ensure its continuity. With CHF 2 billion under management, it has sufficient resources to finance its future growth. This solidity is further underlined by its FINMA CISA licence. Finally, registered with the SEC, Forum Finance can also look after American clients.

Offering a compelling alternative to wealth managers wishing to ‘future proof’ their activities

In view of the recent regulatory changes in the Swiss independent asset management industry, Forum Finance offers a solid framework with an equitable and collaborative culture for wealth managers who have an entrepreneurial spirit.

Hippolyte de Weck, CEO, said: “adding high quality talent is the greatest challenge for any company. We are therefore particularly pleased with the calibre of our new board members and our new partner. They will provide us with valuable guidance and support to grow our business further and prepare ourselves for the decades to come“.

For additional information, please contact:

Egon Vorfeld

The Forum Finance Group SA

T: +41 (0)22 552 83 00

E: vorfeld@ffgg.com

ffgg.com

Ricardo Payro

Payro Communication Sàrl

T: +41 (0)22 322 13 17

E: :rp@payro.ch

payro.ch

About Forum Finance

Founded in 1994 in Geneva, Forum Finance offers private banking and asset management services to a high-end global clientele. It has 25 employees who manage and supervise CHF 2 billion in assets. The company is regulated and supervised by the FINMA under the CISA licence and is registered with the SEC as investment adviser.

Forum Finance wins four awards at the WealthBriefing Swiss EAM Awards 2023

Forum Finance wins four awards at the WealthBriefing Swiss EAM Awards 2023

Forum Finance crowned best independent Swiss asset manager with assets over CHF 1 billion for the third year running.

Forum Finance crowned best independent Swiss asset manager with assets over CHF 1 billion for the third year running.

Forum Finance wins three additional awards for the best Next-Gen program, Wealth Planning team and Servicing North American clients.

Forum Finance wins three additional awards for the best Next-Gen program, Wealth Planning team and Servicing North American clients.

Geneva, 10th March 2023 – Geneva-based independent asset manager The Forum Finance Group SA has won the award for the best independent Swiss asset manager for the third year running at the WealthBriefing Swiss EAM Awards 2023, in the premier category of companies with assets under management of over CHF 1 billion. It won an additional 3 awards for the best Next-Gen program, Wealth Planning team and Servicing North American clients.

Announced during the prize-giving ceremony held last night in Zurich, the awards recognise the best independent Swiss asset management companies, selected through a rigorous process for their “innovation and excellence in 2022” by a panel of experts. The independent jury comprises specialist consultants, representatives of custodian banks and technology solution providers, as well as other industry experts.

In the case of Forum Finance, the panel of judges highlighted: “that the successful onboarding of the next generation of managers and client-facing people have allowed the implementation of excellent strategies which have enabled the company to grow its assets under management and become a leading EAM”. The judges also mentioned that they were “impressed by Forum Finance’s ability to provide specific wealth planning services to families and their Next Generation. Furthermore, the firm has put a lot of effort into hiring the right people to deliver on wealth planning and structuring issues”. With regard to the Servicing North American Clients award, they said: “the winner combines traditional asset management with specific US client services. With their qualifications to manage life assurance policies, together with providing an inhouse international wealth planner makes them a strong partner for US clients. A worthy winner”.

Indeed, having anticipated the changes in the asset management industry, Forum Finance has strengthened its structure and organisation over the last few years, as evidenced by the CISA licence granted by FINMA in 2015 and its registration as investment adviser with the US SEC in 2016. In addition, Forum Finance continues to invest in its research, investment management and wealth advisory resources, as well as in technology, enabling it to respond effectively to the changing needs of its clients.

Hippolyte de Weck, Managing Partner and CEO of Forum Finance, stated: “We are truly honoured to have been awarded these highly regarded industry accolades. Winning all these awards is most rewarding! It is a real testament of our collaborative and equitable corporate culture and our ability to attract great new talent. New talent also brings new ideas and new skills. Two of the awards this year clearly demonstrate that: best Wealth Planning team and Next-Gen program. These were a direct result of us hiring a dedicated wealth planner who is inherently also focussed on the next generation.”

For additional information, please contact:

Egon Vorfeld

The Forum Finance Group SA

T: +41 (0)22 552 83 00

E: vorfeld@ffgg.com

ffgg.com

Ricardo Payro

Payro Communication Sàrl

T: +41 (0)22 322 13 17

E: :rp@payro.ch

payro.ch

About Forum Finance

Founded in 1994 in Geneva, Forum Finance offers private banking and asset management services to a high-end global clientele. It has 25 employees who manage and supervise around CHF 2 billion. The company is authorised under the CISA licence by FINMA and is registered with the SEC as investment adviser.

Handover at Forum Finance

Handover at Forum Finance

Geneva, 28th September 2022 – Geneva-based independent asset manager The Forum Finance Group SA has announced the appointment of Hippolyte de Weck as CEO as of 1st October 2022. He replaces Etienne Gounod, who becomes Chairman of the Board of Directors. This change of generation at the head of the company is part of the governance system that Forum Finance put in place many years ago to organise the gradual retirement of managing partners from the age of 65. While many independent asset management companies will not be able to obtain their FINMA licence before the end of December, Forum Finance offers a solid entrepreneurial framework to wealth managers looking for a structure that will allow them to continue to carry out their activities.

Hippolyte de Weck joined Forum Finance as a managing partner in 2011. Prior to that, he worked within the UBS Group for 17 years, holding various positions in the areas of bond issuance, risk management and private wealth management in Frankfurt, Zurich and Geneva. He succeeds Etienne Gounod as CEO, who is stepping down from the Executive Committee to become Chairman of the Board of Directors.

Etienne Gounod explained: “Our internal governance rules stipulate that at the age of 65 managing partners gradually retire to make room for the next generation. After 13 years as CEO and 19 years as managing partner, it is time for me to hand over the operational management of Forum Finance and focus on the long-term strategy of the company as Chairman of the Board.”

A solid structure and governance

With 28 years of steady growth, Forum Finance has proven its durability. Its robust and transparent governance ensures the integrity of its leadership and allows it to welcome new partners to ensure its continuity. With CHF 2 billion under management, it has sufficient resources to finance its future growth. This solidity is further underlined by its FINMA CISA licence, which allows it to extend its range of services to the management of investment funds and pension products. Finally, registered with the SEC, Forum Finance can also look after American clients.

Offering a compelling solution to wealth managers wishing to continue their activities

In view of the regulatory upheaval that the Swiss independent asset management industry will experience in the coming months, Forum Finance intends to play an active role in the upcoming restructuring process, in particular by offering a credible framework for wealth managers whose company will not obtain the FINMA licence, mandatory from 1st January 2023.

Hippolyte de Weck, CEO, added: “The warnings and figures published by FINMA in August clearly indicate that hundreds of Swiss asset management companies will not obtain this prized licence in time. Our size, the structure we have already put in place, our development prospects and the possibilities we offer to access our equity make Forum Finance a particularly convincing solution for wealth managers looking for a new environment in which to continue their activities.”

For additional information, please contact:

Egon Vorfeld

The Forum Finance Group SA

T: +41 (0)22 552 83 00

E: vorfeld@ffgg.com

ffgg.com

Ricardo Payro

Payro Communication Sàrl

T: +41 (0)79 460 57 74

E: :rp@payro.ch

payro.ch

About Forum Finance

Founded in 1994 in Geneva, Forum Finance offers private banking and asset management services to a high-end global clientele. It has 25+ employees who manage and supervise more than CHF 2 billion in assets. The company is regulated and supervised by the FINMA under the CISA licence and is registered with the SEC as investment adviser.

Allnews - La digitalisation de la gestion de fortune, défi ou solution?

La digitalisation de la gestion de fortune, défi ou solution?

Répondre aux attentes d’une nouvelle génération qui cherche la simplicité de fonctionnement, l’accessibilité à ses comptes, la flexibilité et la rapidité d’exécution … à moindre coût.

Depuis la crise des crédits subprime de 2008, la banque privée Suisse a fait face à de nombreux défis. L’explosion réglementaire, la fin du secret bancaire, la révolution digitale, les taux bas, une pandémie… Ces défis ont testé les limites de la structure des modèles d’affaires existant, mettant à jour la fragilité et le manque de flexibilité de nombreux établissements. De tous ces défis, le plus considérable est sans doute la digitalisation des processus et des structures existantes. Nous allons voir comment certains gérants indépendants ont su industrialiser leur modèle d’affaire et pourquoi les grandes banques prennent généralement du retard.